by Michelle Hopkins | Jan 30, 2026 | Newsletters

OBBB: How to take advantage of no tax on tips and overtime The One, Big, Beautiful Bill has a significant effect on federal taxes, credits and deductions. Millions of taxpayers reported earning tips and overtime on their tax returns, many of them are veterans and...

by Michelle Hopkins | Jan 6, 2026 | Newsletters

IRS Announces Mileage Rate Changes It’s important and complex: the annual change notice for mileage rates for business. The rules can get confusing, and there are choices you need to make based on your situation. Click through for an overview of how the...

by Michelle Hopkins | Dec 19, 2025 | Uncategorized

As online scams increase this time of year, a little caution goes a long way. Keep your data safe with these holiday security reminders. 1. Be alert for holiday-themed phishing emails.Scammers often send fake “bonus,” “payroll update,” or “holiday schedule” emails....

by Michelle Hopkins | Nov 13, 2025 | Newsletters

IRS Provides Penalty Relief from Reporting Requirements of Big Beautiful Bill The IRS recently announced penalty relief to employers for tax year 2025 for reporting requirements under the One Big Beautiful Bill Act (OBBBA) for qualified overtime compensation and cash...

by Michelle Hopkins | Oct 21, 2025 | Newsletters, Uncategorized

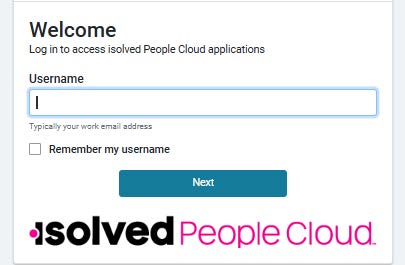

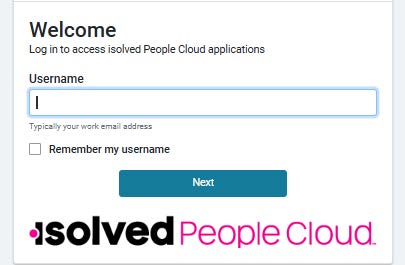

With the increasing sophistication of cybercrime and fraud, the importance of security and risk management of your payroll information is our top priority. To better protect your sensitive information and ensure a secure user experience, we’re upgrading our payroll...

Recent Comments